Some Known Facts About Transaction Advisory Services.

The Greatest Guide To Transaction Advisory Services

Table of ContentsNot known Details About Transaction Advisory Services 10 Simple Techniques For Transaction Advisory ServicesGet This Report on Transaction Advisory Services8 Easy Facts About Transaction Advisory Services ExplainedThe smart Trick of Transaction Advisory Services That Nobody is Discussing

This step makes certain the organization looks its best to potential purchasers. Obtaining the business's value right is important for an effective sale.Purchase advisors action in to help by getting all the needed details arranged, answering questions from purchasers, and setting up brows through to the business's location. This develops depend on with customers and keeps the sale moving along. Obtaining the ideal terms is key. Purchase experts use their know-how to aid entrepreneur manage hard negotiations, meet buyer assumptions, and framework bargains that match the proprietor's objectives.

Fulfilling lawful guidelines is vital in any type of business sale. Purchase consultatory services deal with legal experts to develop and assess contracts, agreements, and various other lawful papers. This decreases risks and makes certain the sale complies with the legislation. The role of transaction consultants prolongs past the sale. They help local business owner in planning for their following actions, whether it's retired life, starting a brand-new endeavor, or managing their newly found wide range.

Deal experts bring a wealth of experience and understanding, ensuring that every aspect of the sale is handled professionally. Through tactical preparation, appraisal, and settlement, TAS assists company owner achieve the highest feasible list price. By making sure legal and governing conformity and handling due diligence together with other offer staff member, transaction consultants lessen prospective threats and responsibilities.

The smart Trick of Transaction Advisory Services That Nobody is Talking About

By contrast, Big 4 TS teams: Deal with (e.g., when a possible purchaser is carrying out due diligence, or when an offer is closing and the purchaser needs to integrate the business and re-value the seller's Annual report). Are with fees that are not linked to the deal closing successfully. Earn fees per interaction somewhere in the, which is less than what investment banks earn also on "tiny offers" (however the collection likelihood is likewise a lot higher).

, but they'll concentrate a lot more on bookkeeping and valuation and much less on topics like LBO modeling., and "accounting professional only" topics like test balances and just how to walk through occasions using debits and credit scores instead than financial declaration adjustments.

Get This Report on Transaction Advisory Services

Specialists in the TS/ FDD teams might additionally speak with administration about everything over, and they'll compose an in-depth report with their findings at the end of the procedure.

The power structure in Deal Services varies a bit from the ones in investment financial and personal equity professions, and the basic form appears like this: The entry-level role, where you do a great deal of data and financial analysis (2 years for a promo from here). The following degree up; similar job, but you get the even more interesting little bits (3 years for a promotion).

Specifically, it's challenging to get advertised past the Manager level since few individuals leave the task at that stage, and you need to begin showing proof of your capacity to create revenue to advancement. Allow's begin with the hours and way of life considering that those are less complicated to describe:. There are occasional late nights and weekend work, however absolutely nothing like the agitated nature of investment banking.

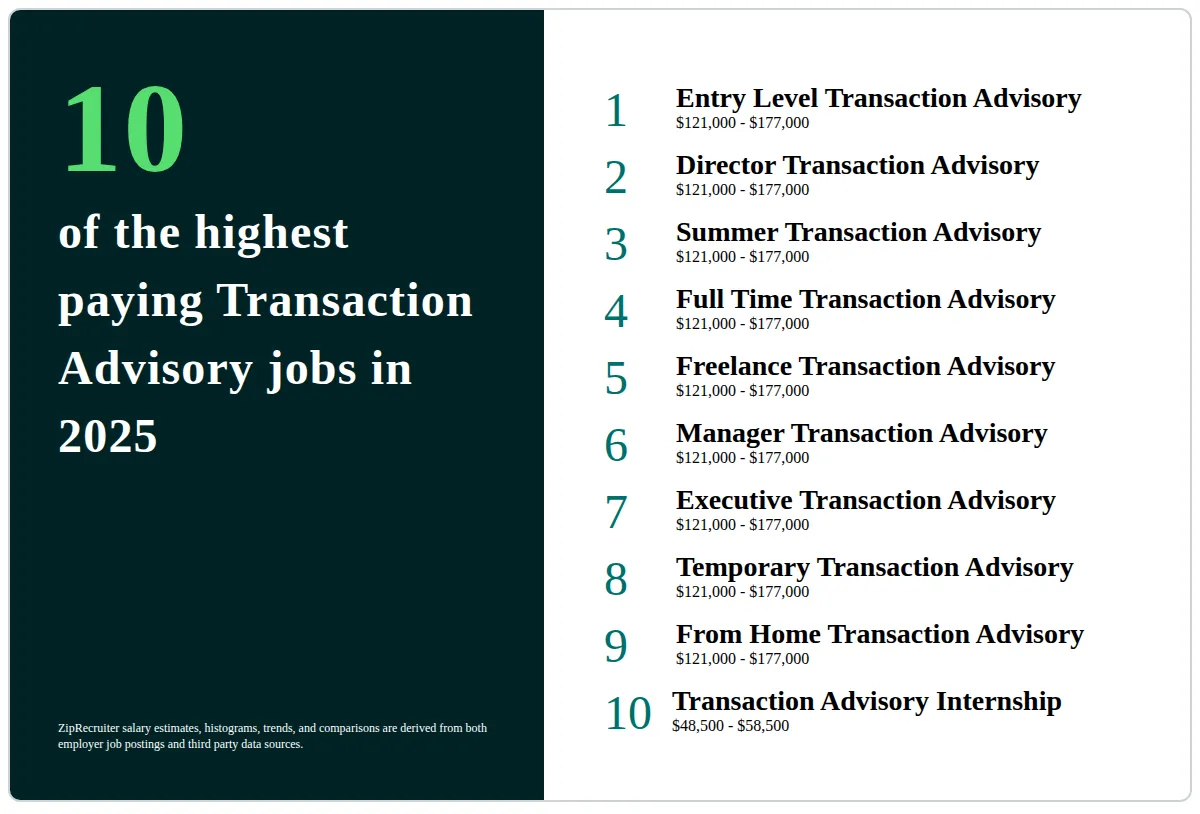

There are cost-of-living adjustments, so expect reduced compensation if you're in a cheaper place outside significant monetary (Transaction Advisory Services). For all placements except Partner, the base pay comprises the bulk of the overall settlement; the year-end bonus offer may be a max of 30% of your base wage. Typically, the official source ideal method to raise your earnings is to change to a various firm and discuss for a greater more helpful hints salary and benefit

How Transaction Advisory Services can Save You Time, Stress, and Money.

You could get into company development, however investment banking obtains harder at this stage since you'll be over-qualified for Analyst functions. Business financing is still a choice. At this stage, you ought to just stay and make a run for a Partner-level role. If you wish to leave, possibly transfer to a customer and do their evaluations and due persistance in-house.

The main problem is that due to the fact that: You generally require to sign up with one more Big 4 team, such as audit, and job there for a couple of years and after that move right into TS, job there for a few years and afterwards relocate right into IB. And there's still no assurance of winning this IB role due to the fact that it relies on your region, clients, and the working with market at the time.

Longer-term, there is additionally some danger of and because reviewing a company's historic monetary information is not specifically brain surgery. Yes, people will constantly require to be involved, yet with advanced technology, reduced head counts could potentially support customer engagements. That claimed, the Deal Services team beats audit in regards to pay, work, and leave possibilities.

If you liked this post, you could be curious about reading.

9 Easy Facts About Transaction Advisory Services Shown

Create sophisticated financial structures that assist navigate to this website in identifying the actual market value of a firm. Offer consultatory work in connection to company appraisal to assist in bargaining and pricing structures. Explain one of the most ideal kind of the offer and the type of consideration to employ (cash, supply, gain out, and others).

Establish action plans for risk and direct exposure that have actually been identified. Carry out integration preparation to identify the process, system, and organizational adjustments that may be required after the bargain. Make mathematical quotes of integration costs and advantages to examine the economic reasoning of combination. Set standards for integrating departments, modern technologies, and organization processes.

Determine potential decreases by lowering DPO, DIO, and DSO. Analyze the potential client base, sector verticals, and sales cycle. Take into consideration the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The functional due diligence supplies vital insights into the functioning of the company to be obtained worrying risk assessment and value production. Determine temporary modifications to financial resources, banks, and systems.